200db depreciation calculator

The macrs depreciation calculator is specifically designed to calculate how fast the value of an asset decreases over time. You now have 90000 subject to depreciation.

Appliance Depreciation Calculator

It is fairly simple to use.

. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. The calculator makes this calculation of course Asset Being Depreciated -. That percentage will be multiplied by the.

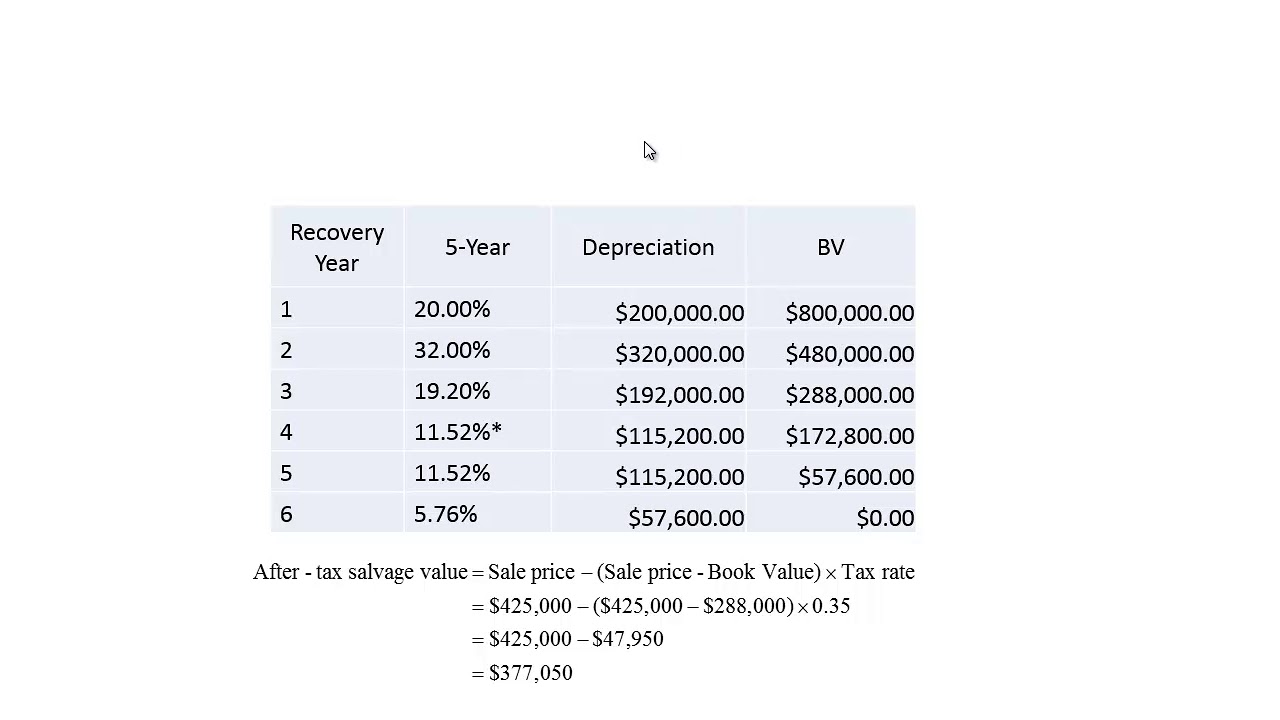

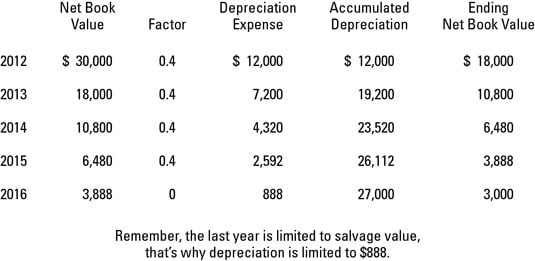

The book value of 64000 multiplied by 20 is 12800 of depreciation expense for Year 3. Macrs Depreciation Tables How To Calculate. The MACRS Depreciation Calculator uses the following basic formula.

Example of 200 reducing balance depreciation The 200 reducing balance method divides 200 percent by the service life years. Take the 100000 asset acquisition value and subtract the 10000 estimated salvage value. The calculator also estimates the first year and the total vehicle depreciation.

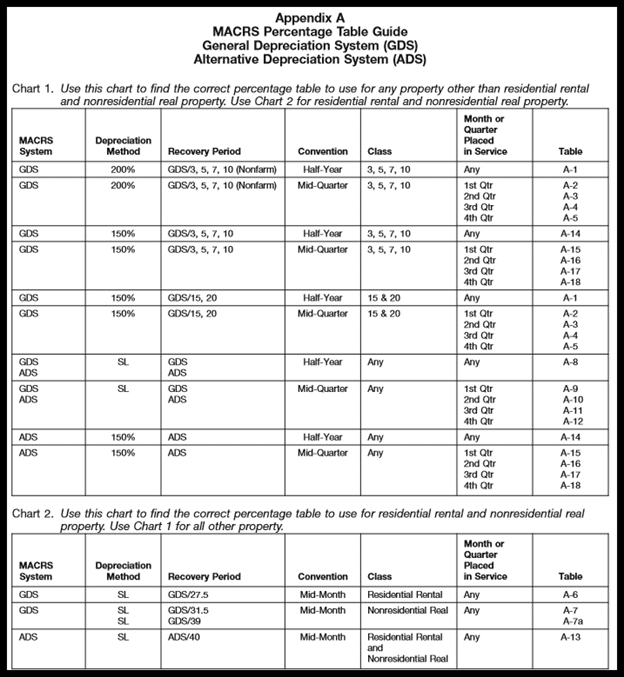

D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the depreciation. Determine the Life of Each Asset Placed in Service During the Year. Therefore the book value of.

Select the currency from the drop-down list optional Enter the. All you need to do is. Referring to back to the machine example discussed earlier if you expect the 10000 machine to last for 5 years with a salvage value of 100000 and you place the machine in service in July.

Determining the MACRS life of an asset is usually pretty straightforward and must be based on. Section 179 deduction dollar limits. At the beginning of Year 4 the assets book value will be 51200.

Table 8 2 Accelerated Depreciation For Personal Chegg Com. Well you can use this tool to compare three different models of. 4562 Half Year Mid Month And Quarter Conventions 1120 1120s.

This limit is reduced by the amount by which the cost of. The 200 or double-declining depreciation simply means that the depreciation rate is double the straight-line depreciation rate used for later property classes. Can someone please explain me how depreciation calculation happens for all 5 years with following financial information.

You would take 90000 and. If you enter 100000 for basis and business use is 80 then the basis for depreciation adjusted basis is 80000.

Depreciation Macrs Youtube

Guide To The Macrs Depreciation Method Chamber Of Commerce

2

How To Use The Excel Ddb Function Exceljet

Double Declining Depreciation Calculator Efinancemanagement

How To Calculate Macrs Depreciation When Why

Macrs Depreciation Calculator Straight Line Double Declining

2

Lesson 7 Video 5 Declining Balance Switching To Straight Line Depreciation Method Youtube

Depreciation Methods Dummies

Macrs Depreciation Calculator Irs Publication 946

Double Declining Balance Depreciation Calculator

How To Use The Excel Db Function Exceljet

Double Declining Balance Calculator For Depreciating Assets

Double Declining Depreciation Calculator 100 Free Calculators Io

The Mathematics Of Macrs Depreciation

Free Macrs Depreciation Calculator For Excel